Business

8 Key Investment Trends Shaping the Future of Your Portfolio

In today’s rapidly evolving investment landscape, it’s crucial for investors to stay abreast of the key trends that are shaping the future of their portfolios.

From the impact of emerging markets to the growing influence of sustainable investing, there are several significant factors influencing investment decisions.

Understanding these trends and how they can potentially affect your portfolio’s performance is essential for informed decision-making.

As we explore each of these 8 key investment trends, you’ll gain valuable insights into potential opportunities and risks that could shape the trajectory of your investments in the years to come.

Key Takeaways

- Regularly monitor market trends and analyze financial indicators to stay informed about investment opportunities and risks.

- Diversify your portfolio across different asset classes and geographical regions to mitigate risk.

- Consider incorporating environmental, social, and governance (ESG) investing principles for risk mitigation and value creation.

- Embrace a forward-thinking and adaptable approach to asset allocation, exploring unconventional asset classes and investment vehicles.

Market Analysis

Regularly monitoring market trends and analyzing financial indicators is essential for making informed investment decisions. Market analysis involves a comprehensive evaluation of various factors that can impact investment performance. This includes assessing economic data, industry trends, geopolitical events, and company-specific information. By leveraging data-driven insights, investors can identify potential opportunities and mitigate risks within their portfolios.

One crucial aspect of market analysis is the examination of macroeconomic indicators such as GDP growth, inflation rates, and employment figures. These factors provide valuable insights into the overall health of the economy and can help investors anticipate potential market movements.

Additionally, analyzing sector-specific trends and company financials can offer a more granular view, enabling investors to capitalize on emerging trends or adjust their positions accordingly.

Furthermore, monitoring market sentiment through tools like technical analysis and investor sentiment indicators can provide additional layers of insight. Understanding the psychology of market participants and identifying potential market inefficiencies can offer a competitive edge in decision-making.

Portfolio Diversification

Utilizing a diversified portfolio allocation strategy is imperative for optimizing risk-adjusted returns and enhancing long-term performance in investment endeavors. The concept of portfolio diversification revolves around spreading investments across different asset classes such as stocks, bonds, real estate, and commodities to mitigate risk. Research has consistently shown that diversification can lead to more stable and consistent returns over time, reducing the impact of volatility in any one asset or market sector.

In today’s dynamic investment landscape, diversification can also involve geographical diversification, investing in both domestic and international markets to further spread risk. Additionally, alternative investments such as private equity, hedge funds, and venture capital are increasingly being considered as part of a well-diversified portfolio.

Furthermore, the emergence of environmental, social, and governance (ESG) investing has brought a new dimension to portfolio diversification, allowing investors to align their portfolios with their values while potentially enhancing long-term risk-adjusted returns.

Asset Allocation

An effective asset allocation strategy is crucial for optimizing investment performance and managing risk in a dynamic market environment. In today’s investment landscape, traditional asset allocation models are being challenged by a confluence of factors, including geopolitical uncertainties, technological disruptions, and shifting demographic trends. As investors seek to navigate these complexities and achieve their financial goals, a nuanced approach to asset allocation becomes increasingly vital.

Data analysis reveals that a strategic asset allocation that encompasses a diversified mix of asset classes, such as equities, fixed income, real estate, and alternative investments, can enhance risk-adjusted returns. Furthermore, the growing popularity of environmental, social, and governance (ESG) considerations has led investors to integrate sustainable and responsible investment principles into their asset allocation strategies, recognizing the potential for long-term value creation and risk mitigation.

In this era of market volatility and rapid innovation, the freedom to explore unconventional asset classes and investment vehicles has become a defining feature of modern asset allocation. By embracing a forward-thinking and adaptable approach, investors can position their portfolios to capitalize on emerging opportunities and navigate the evolving investment landscape with resilience and confidence.

Risk Management

Risk mitigation is a critical aspect of effective portfolio management, especially in today’s dynamic and uncertain market conditions. In the current investment landscape, the ability to assess and manage risk is paramount for ensuring long-term portfolio success.

One key approach to risk management is diversification. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of adverse events on their overall portfolio. Additionally, incorporating assets with low correlation can further enhance diversification benefits.

Furthermore, the utilization of risk management tools, such as options and futures, can provide a way to hedge against potential downturns in the market. These instruments offer opportunities to protect portfolios from adverse movements while still allowing for potential gains.

Moreover, integrating risk management strategies that align with individual risk tolerance and investment goals is crucial. This involves regular portfolio reviews and adjustments to ensure that risk levels remain within predefined boundaries.

Retirement Planning

Given the importance of long-term financial stability, prudent retirement planning is a natural extension of effective risk management strategies within a well-structured investment portfolio. In today’s dynamic economic landscape, retirement planning has become increasingly complex due to factors such as longer life expectancies, rising healthcare costs, and evolving government policies. As individuals seek financial freedom in their retirement years, it is imperative to consider various investment trends that can shape the future of their portfolios.

One key trend in retirement planning is the shift towards self-directed retirement accounts, allowing individuals greater control over their investment choices. This trend aligns with the desire for autonomy and flexibility in managing retirement funds. Additionally, the growing popularity of sustainable and socially responsible investing presents an opportunity for individuals to align their retirement goals with their values, contributing to a sense of purpose and fulfillment in later years.

Furthermore, the rise of digital investment platforms and robo-advisors has democratized access to sophisticated retirement planning tools, empowering individuals to make informed decisions and optimize their portfolios with minimal barriers to entry. These technological advancements enable greater transparency, cost efficiency, and customization, catering to the evolving needs of retirees in an increasingly digital world.

As retirement planning continues to evolve, staying informed about these investment trends is essential for building a resilient and adaptive retirement portfolio that aligns with individual goals and aspirations.

Emerging Markets

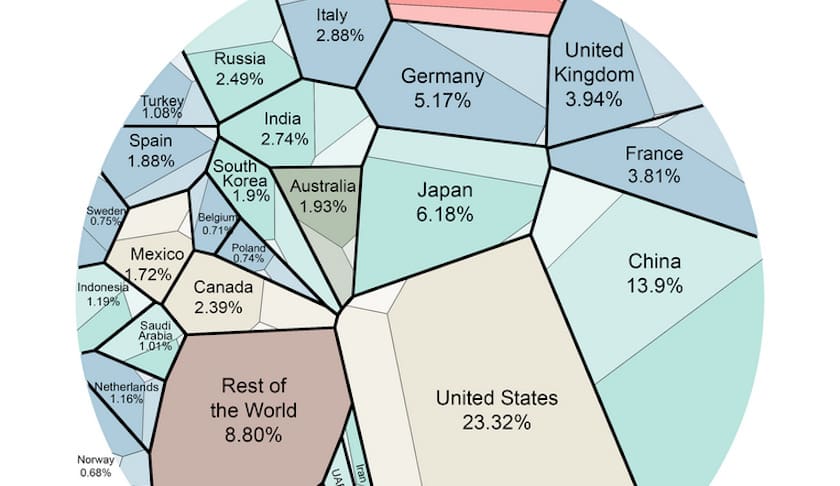

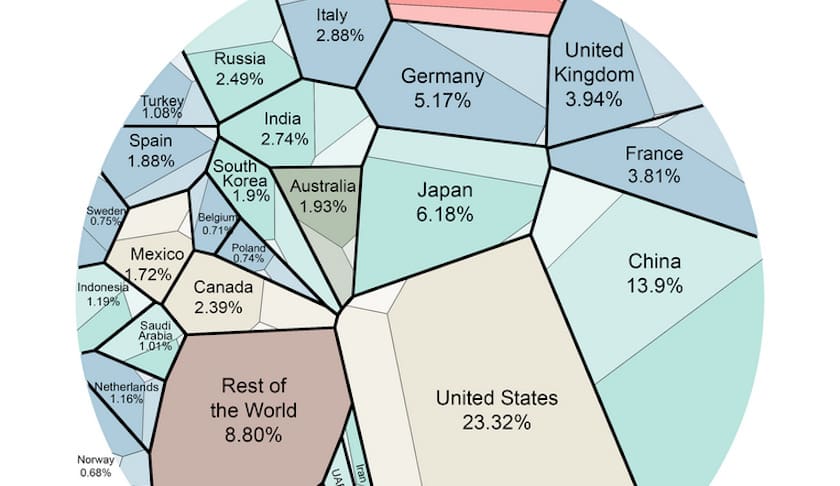

The surge in economic growth and market potential in emerging markets has captured the attention of savvy investors seeking diversification and higher returns in their portfolios. With a combined GDP that is expected to surpass that of the developed world by 2023, emerging markets present a compelling investment opportunity. The demographic trends in these markets, characterized by a burgeoning middle class and a youthful population, further bolster their attractiveness.

According to the International Monetary Fund, emerging and developing Asia is projected to grow by 8.6% in 2021, outpacing advanced economies. Additionally, the World Bank forecasts that Sub-Saharan Africa will rebound to 3.3% growth in 2021, led by a recovery in commodity exporters. These statistics underscore the potential for strong returns in emerging markets.

Furthermore, technological advancements and infrastructure developments are paving the way for increased productivity and consumer demand in these regions. As political and economic reforms take hold, the investment landscape in emerging markets is becoming more conducive to foreign investment.

However, it is crucial for investors to carefully assess the risks and opportunities inherent in these markets and to diversify their portfolios effectively. As global economic power continues to shift, allocating a portion of one’s investment portfolio to emerging markets can be a strategic move to capture growth and enhance overall returns.

Sustainable Investing

Sustainable investing has gained significant traction in recent years, driven by the integration of Environmental, Social, and Governance (ESG) criteria into investment decisions.

Investors are increasingly seeking opportunities that align with their values and have a positive impact on the world, leading to the rise of impact investing.

This trend reflects a growing awareness of the importance of sustainable business practices and their potential to deliver long-term financial returns.

ESG Criteria

Analyzing companies based on their environmental, social, and governance (ESG) criteria has become an integral part of the investment decision-making process, as it provides valuable insights into their long-term sustainability and risk management practices. As sustainable investing gains momentum, investors are increasingly considering ESG factors to align their portfolios with their values and contribute to positive societal and environmental impacts.

Here are four compelling reasons why ESG criteria are shaping the future of investment decisions:

- Social Impact: Investors seek companies that positively contribute to society.

- Environmental Stewardship: Environmentally responsible companies are favored for their sustainable practices.

- Corporate Governance: Ethical and transparent governance practices build investor trust and confidence.

- Risk Management: Companies with strong ESG profiles tend to exhibit better resilience and risk management in the long run.

Impact Investing

A growing number of investors are integrating impact investing strategies into their portfolios to generate financial returns while also making a positive social or environmental impact. This trend is being driven by the increasing awareness of the long-term implications of environmental and social issues, as well as the potential for sustainable investing to deliver competitive financial returns.

According to a report by the Global Impact Investing Network (GIIN), the impact investing market has grown to over $700 billion, indicating a substantial increase in investor interest in aligning their financial goals with their values. Furthermore, research from Morningstar shows that sustainable funds have continued to attract significant inflows, with global sustainable fund assets reaching a record $2 trillion in 2020.

As impact investing continues to gain momentum, it is poised to play an increasingly significant role in shaping the future of investment portfolios.

Technology Stocks

Investors are increasingly turning their attention to technology stocks as they seek opportunities for growth and innovation in the market. The tech sector continues to be a hotbed for investment, driven by transformative advances in areas such as artificial intelligence, cloud computing, and e-commerce.

Here are four key reasons why technology stocks are capturing the imagination of investors:

- Innovation: Technology companies are at the forefront of innovation, constantly pushing boundaries and disrupting traditional industries, which can lead to substantial returns for investors.

- Growth Potential: The rapid evolution of technology means that many tech stocks have significant growth potential, offering the possibility of substantial returns on investment.

- Resilience: The COVID-19 pandemic has highlighted the resilience of technology stocks, with many companies demonstrating their ability to adapt and thrive in challenging conditions.

- Global Impact: Technology companies have a global reach, and their products and services often have a profound impact on society, making investing in them a way to contribute to positive change on a large scale.

As investors seek to align their portfolios with their values and goals, technology stocks are increasingly becoming a focal point for those who desire freedom and growth in their investments.

Frequently Asked Questions

How Can Geopolitical Events Impact the Future of My Portfolio?

Geopolitical events can significantly impact portfolios due to their influence on global markets, currency exchange rates, and trade agreements. Understanding how these events affect specific industries and regions is crucial for informed investment decision-making.

What Are Some Alternative Investment Options Beyond Traditional Stocks and Bonds?

When seeking alternative investment options beyond traditional stocks and bonds, consider real estate, commodities, private equity, and venture capital. Diversifying your portfolio through these assets can offer opportunities for higher returns and risk mitigation.

How Can I Protect My Portfolio From Unexpected Market Downturns?

To protect your portfolio from unexpected market downturns, diversify across asset classes, use risk management strategies like stop-loss orders, and consider alternative investments such as real estate or commodities to provide a hedge against traditional market fluctuations.

What Are Some Strategies for Maximizing Retirement Income in a Changing Economic Landscape?

In a changing economic landscape, maximizing retirement income requires a diversified investment approach, careful risk management, and a focus on income-generating assets. It’s crucial to adapt strategies to evolving market conditions and long-term financial goals.

How Can I Incorporate Environmental, Social, and Governance (Esg) Factors Into My Investment Decisions?

Incorporating environmental, social, and governance (ESG) factors into investment decisions involves evaluating companies’ sustainability practices, social impact, and ethical governance. This can be achieved through ESG screening, integration, and engagement strategies to align investments with values and long-term performance.

Hi, I’m Kyle Rivera, a news journalist and blog editor with the Daily Evening News. A TCU alum with a flair for storytelling, I spend my days uncovering impactful stories and my evenings exploring the realms of yoga, cycling, and whimsically bad poetry.

Travel is my escape; I’ve trekked from Tokyo’s neon lights to Iceland’s tranquil vistas. But no journey is complete without Mogli, my Golden Retriever, who’s redefining his breed standards in the most charming ways.

I love connecting with fellow travelers, yogis, cyclists, and anyone who enjoys a laugh at my poetic attempts. If you’re into stories that inspire, travel escapades, or just want to see what Mogli and I are up to, I’d love to hear from you on Instagram or Facebook. Let’s share tales and tips from around the globe!