Business

What Signs Suggest That an Economy Is Headed for Stability or Turmoil?

As the global economy continues to navigate through various challenges, it becomes imperative to understand the signs that indicate the direction in which an economy is headed.

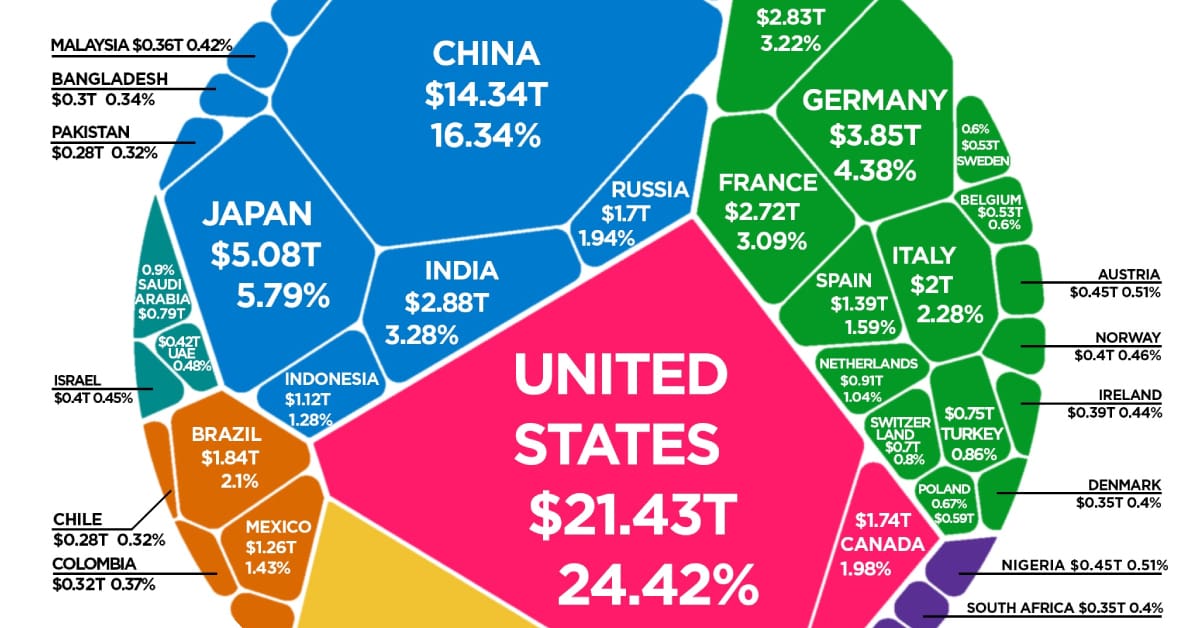

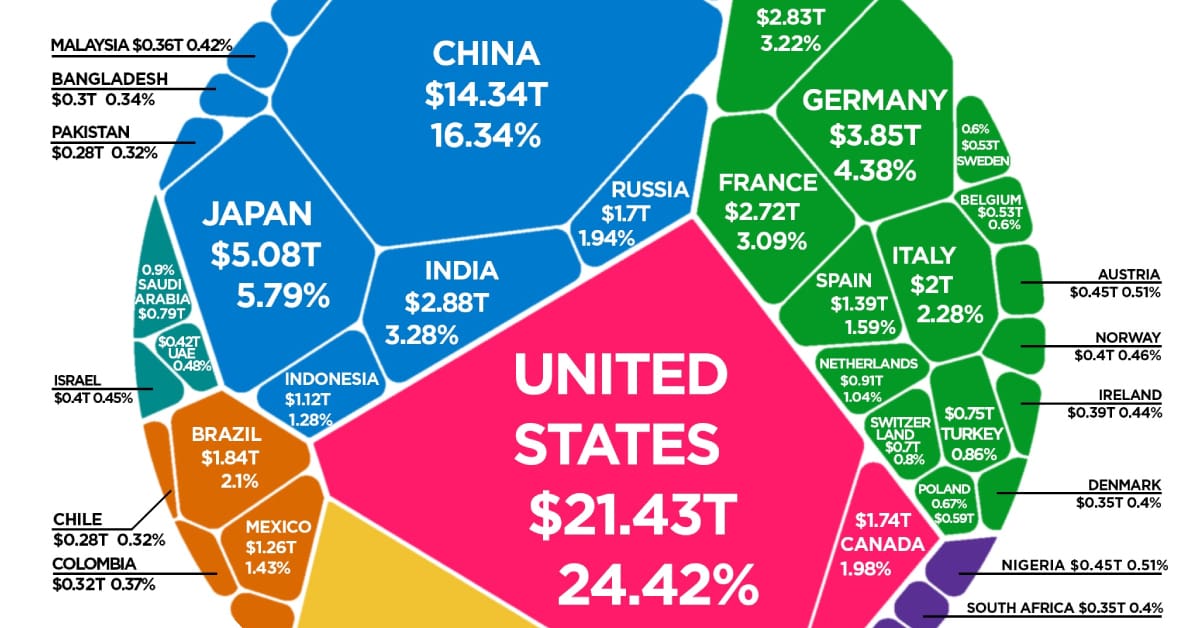

The indicators are multifaceted and often interlinked, encompassing measures such as GDP growth, inflation rates, unemployment levels, and government debt, among others. Each of these factors plays a crucial role in signaling whether an economy is moving towards stability or potential turmoil.

Understanding these signs and their implications is essential for businesses, policymakers, and individuals alike, as they navigate through the complexities of the economic landscape.

Key Takeaways

- Consistently high GDP growth rates and moderate inflation indicate a robust and healthy economy, while stagnant or declining GDP growth rates and high inflation may signal economic turmoil or potential recession.

- Monitoring unemployment levels and balance of trade provides valuable insights into economic health. Rising unemployment rates and negative balance of trade can indicate reduced consumer spending and economic turmoil, while low unemployment rates and positive balance of trade signify a strong and stable economy.

- Government debt and foreign exchange reserves are crucial indicators of fiscal health. Sustained increase in government debt may raise concerns about fiscal sustainability, while adequate foreign exchange reserves ensure confidence in meeting external obligations and mitigate potential shocks.

- Fluctuations in interest rates can impact stock market performance and investor sentiment. Rising interest rates tend to cause stock prices to fall, while falling interest rates tend to cause stock prices to rise. Understanding the potential impact of interest rates on stock market performance is essential for making informed investment decisions.

GDP Growth and Inflation Rates

The GDP growth and inflation rates provide crucial indicators for assessing the economic stability or turmoil of a country’s financial landscape.

GDP growth measures the increase in the value of goods and services produced by an economy, reflecting its overall economic health. A consistently high GDP growth rate indicates a robust economy with increasing production and consumption, signaling stability. On the other hand, a stagnant or declining GDP growth rate may indicate economic turmoil, signaling a potential recession or economic downturn.

Inflation rates, on the other hand, measure the increase in prices of goods and services over time. While moderate inflation is a sign of a healthy, growing economy, high inflation can erode purchasing power and destabilize the economy. Conversely, deflation, or decreasing prices, can signal decreased consumer spending and business investment, leading to economic instability.

Analyzing these indicators in conjunction provides a comprehensive understanding of an economy’s stability or turmoil. Governments and policymakers use this data to make informed decisions about fiscal and monetary policies, while businesses and investors rely on these indicators to assess risks and opportunities.

Unemployment Levels and Balance of Trade

With regards to unemployment levels and balance of trade, these two indicators play a significant role in assessing a country’s economic stability or turmoil.

Unemployment levels reflect the health of the labor market and the overall economic activity. Rising unemployment rates can indicate a lack of job opportunities, leading to reduced consumer spending and economic instability. On the other hand, low unemployment rates may indicate a robust economy with high consumer confidence and spending.

Furthermore, the balance of trade, which measures the difference between a country’s imports and exports, is crucial in determining the health of an economy. A negative balance of trade, or trade deficit, can lead to a reduction in a country’s foreign exchange reserves and can be an indicator of economic turmoil. Conversely, a positive balance of trade, or trade surplus, can signify a strong economy and potential stability.

Monitoring these indicators provides valuable insights into the overall economic health of a nation, allowing for informed decision-making and policy adjustments to maintain economic stability.

Government Debt and Foreign Exchange Reserves

Amidst the complex web of economic indicators, government debt and foreign exchange reserves stand as pivotal measures of a nation’s fiscal health. Government debt reflects the accumulation of past borrowing to finance deficits, and its sustained increase can lead to concerns about fiscal sustainability. High levels of government debt may signal a future need for increased taxation or reduced public spending, potentially hindering economic growth and stability.

On the other hand, adequate foreign exchange reserves are crucial for maintaining confidence in a country’s ability to meet its external obligations and stabilize its currency. Sufficient reserves can help mitigate potential external shocks and ensure smooth international transactions, contributing to overall economic stability.

Analyzing government debt and foreign exchange reserves provides valuable insights into a nation’s ability to manage its finances and external economic relations. Excessive government debt and inadequate foreign exchange reserves can indicate vulnerability to economic turmoil, while prudent management of these factors can signal stability and resilience. Therefore, monitoring these indicators is essential for understanding the broader economic trajectory and making informed policy decisions to support sustainable growth and financial stability.

Interest Rates and Stock Market Performance

Correlating with fluctuations in interest rates, stock market performance serves as a critical barometer of investor sentiment and economic expectations. When interest rates rise, borrowing becomes more expensive, leading to decreased consumer spending and decreased business investment. This can have a negative impact on corporate profits and ultimately stock prices. Conversely, when interest rates are low, borrowing becomes cheaper, stimulating consumer spending and business investment, which can lead to increased corporate profits and higher stock prices.

Empirical evidence suggests that there is an inverse relationship between interest rates and stock market performance. Historical data indicates that when interest rates are rising, stock prices tend to fall, and when interest rates are falling, stock prices tend to rise. This relationship is not absolute and is subject to various other factors, including inflation, economic growth, and geopolitical events. However, it does highlight the significance of interest rates in influencing stock market dynamics.

For investors and policymakers, monitoring interest rate movements and understanding their potential impact on stock market performance is crucial for making informed decisions and anticipating economic trends.

Economic Policy and Consumer Confidence

The effectiveness of economic policy measures can significantly influence consumer confidence and subsequently impact overall economic performance. When economic policies are perceived as sound and conducive to growth, consumer confidence tends to rise. This confidence often translates into increased spending, investment, and overall economic activity. On the contrary, poorly executed or uncertain economic policies can lead to a decrease in consumer confidence, resulting in reduced spending and investment, which can ultimately hinder economic growth.

Data on consumer confidence, often measured through surveys and indices, provides valuable insights into the effectiveness of economic policies. For instance, when consumer confidence is high, it indicates that economic policies are likely supporting growth and stability. Conversely, declining consumer confidence can signal concerns about the direction of economic policies and their potential impact on the economy.

Policy transparency, consistency, and responsiveness to economic conditions are crucial factors in shaping consumer confidence. Governments and central banks that demonstrate a commitment to prudent economic policies and respond effectively to economic challenges can foster a more positive environment for consumers and businesses, supporting overall economic stability and growth.

Frequently Asked Questions

What Impact Do Social and Political Factors Have on an Economy’s Stability or Turmoil?

Social and political factors can significantly impact an economy’s stability. For instance, civil unrest and government instability can lead to decreased investor confidence, capital flight, and reduced economic activity, creating turmoil and uncertainty in the market.

How Do Changes in Technology and Innovation Affect the Economic Outlook?

Changes in technology and innovation significantly influence the economic outlook by driving productivity, competition, and consumer demand. Technological advancements can lead to increased efficiency, new market opportunities, and disruptions in traditional industries, impacting the overall stability or turmoil of an economy.

What Role Do Natural Disasters and Global Events Play in Determining Economic Stability or Turmoil?

Natural disasters and global events can significantly impact economic stability or turmoil. They disrupt supply chains, increase commodity prices, and create uncertainty. The economic fallout depends on the severity, duration, and global interconnectedness of these events.

How Do Changing Demographics and Migration Patterns Influence an Economy’s Trajectory?

Just as a river’s currents shape its course, changing demographics and migration patterns profoundly influence an economy’s trajectory. These factors impact labor force dynamics, consumer behavior, and demand for goods and services, playing a pivotal role in economic stability or turmoil.

What Is the Role of Psychological Factors, Such as Investor Sentiment and Consumer Behavior, in Determining Economic Stability or Turmoil?

Psychological factors, like investor sentiment and consumer behavior, play a crucial role in determining economic stability or turmoil. Their impact on market trends, investment decisions, and consumer spending can significantly influence the overall health of an economy.

Hi, I’m Kyle Rivera, a news journalist and blog editor with the Daily Evening News. A TCU alum with a flair for storytelling, I spend my days uncovering impactful stories and my evenings exploring the realms of yoga, cycling, and whimsically bad poetry.

Travel is my escape; I’ve trekked from Tokyo’s neon lights to Iceland’s tranquil vistas. But no journey is complete without Mogli, my Golden Retriever, who’s redefining his breed standards in the most charming ways.

I love connecting with fellow travelers, yogis, cyclists, and anyone who enjoys a laugh at my poetic attempts. If you’re into stories that inspire, travel escapades, or just want to see what Mogli and I are up to, I’d love to hear from you on Instagram or Facebook. Let’s share tales and tips from around the globe!